Non-revolving Term Loan Meaning

Non revolving credit is typically in the form of an installment loan which is a loan paid off with regular monthly payments. Principal and interest payments are to be paid monthly.

Https Www Davispolk Com Files A Fresh Look At Acquisition Financing Terms Pdf

In a car loan credit is extended and repaid through a fixed installment plan.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

Non-revolving term loan meaning. Unlike revolving credit once non-revolving credit has been used up then reused or replenished. Examples of Non-Revolving Line in a sentence Borrower authorize DPW at its option to charge such interest all DPW Expenses and all Periodic Payments against the Non-Revolving Line in which case those amounts shall thereafter accrue interest at the rate then applicable hereunder. A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations.

It cant be used again after its paid off. Non-revolving credit is when credit is extended via a fixed repayment plan. These types of lines have lower monthly payments than non-revolving lines of credit.

If the repayment agreement means the balance will go down each month until it is repaid. Non-revolving credit This is a line of credit or a loan with a set monthly payment and a set pay-off date. It is not considered a term loan because during an allotted period of time the.

The Term Loan will be repaid over 29 months commencing April 1 2021. The most common form of non-revolving credit facility would be the unsecured business term loan. Deeper definition With a non-revolving loan the entire sum is paid out at approval because the customer needs to finance something right away like if shes paying for a house or car and once the.

Instead of receiving a lump sum of cash as you would with a traditional loan a non-revolving line of credit gives you access to a credit limit assigned by the lender. Revolving debt generally refers to credit card debts. To gain access to more non-revolving credit the borrower must re-apply.

Mortgage is needed for the revolving loan. A term loan is a loan issued by a bank for a fixed amount and fixed repayment schedule with either a fixed or floating interest rate. The sum is paid back over time with interest additionally assessed.

Non-revolving credit is different from revolving credit in one major way. The terms of the Term Loan Facility are materially unchanged from the previous Amended Term Loan Facility established in January 2017. An example of non-revolving credit would be a car loan.

Interest Rate is comparatively lower than Revolving Loan. Whats more non-revolving credit policy is generally strict. Non-revolving loan is considered as a term loan where regular installment to be paid by the borrower.

Non revolving credit is commonly found in home loans car loans and business loans. An installment loan is given in a lump principal sum. The Loan is a non-revolving loan and Borrower may borrow up to the principal amount during the term of the Loan so long as no Event of Default hereinafter defined has occurred and is continuing.

The funded principal amount after the original issuer discount is US. A non-revolving line of credit is similar to its revolving counterpart in a few ways. Non-Revolving Credit Defined.

The borrower will then make installment payments back against the principal loan. Non-revolving debt is a broader category that includes motor vehicle loans and all other loans not included in revolving credit such as loans for mobile homes education boats trailers or vacations as the Federal Reserve Board explains. Non-revolving Credit usually comes with fixed interest rates and fixed repayment plans.

Companies often use a term loans proceeds to purchase fixed. Term debt is a loan with a set payment schedule over several months or years. When the term non-revolving is used it basically means the credit facility is granted on one-off basis and disbursed fully.

Examples are student loans and auto loans that cant be used again once theyve been repaid. As payments are paid on non-revolving credit plans further credit is not extended unlike in a revolving credit plan. For example say you borrow 50000 and pay the money back with.

Like a car loan or student loans a non-revolving line of credit is a lump sum paid at once. Sample 1 Sample 2. For example a business loan is a type of non-revolving line of credit.

Non-Revolving Line of Credit. Borrower can not re-use the paid installment. Principal is due January 31 2024 with an interest rate of 10.

The difference between term and revolving debt.

Revolving Vs Non Revolving Credit What S The Difference Fox Business

Revolving Vs Non Revolving Credit What S The Difference Fox Business

Difference Between Revolving And Non Revolving Credit Facilities

Difference Between Revolving And Non Revolving Credit Facilities

Difference Between Revolving Non Revolving Lines Of Credit

Difference Between Revolving Non Revolving Lines Of Credit

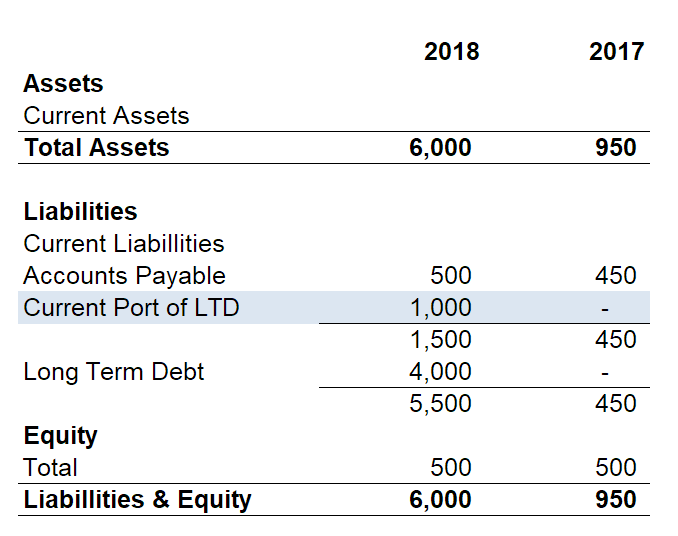

Current Portion Of Long Term Debt Overview Calculation And Example

Current Portion Of Long Term Debt Overview Calculation And Example

Revolving Vs Non Revolving Lines Of Credit Fora Financial Blog

Revolving Vs Non Revolving Lines Of Credit Fora Financial Blog

Https Greenbank Ny Gov Media Greenbanknew Files Rfp1 Indicative Term Sheet Pdf

The Difference Between Revolving Vs Non Revolving Line Of Credit

The Difference Between Revolving Vs Non Revolving Line Of Credit

Https Www Davispolk Com Sites Default Files 2019 07 10 Dealing With Difficult Conditions In The Term Loan B Market Pdf

Loans How To Apply Types Of Loans Eligibility Documents Features And Benefits

Loans How To Apply Types Of Loans Eligibility Documents Features And Benefits

Difference Between Term Loan And Overdraft Inteccapital

Types Of Credit Facilities Short Term And Long Term

Types Of Credit Facilities Short Term And Long Term

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg) Cash Flow Statement Analyzing Cash Flow From Financing Activities

Cash Flow Statement Analyzing Cash Flow From Financing Activities

High Yield Bonds And Leveraged Loans A Convergence Of Terms Ashurst

High Yield Bonds And Leveraged Loans A Convergence Of Terms Ashurst

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/GettyImages-172204552-c1caa6c87e3d4fe4854253c80fd075c1.jpg)