Maximum Fha Loan Amount Alabama

You can view the 2021 FHA loan limits for Alabama on this page. 2021 FHA Mortgage Loan Limits for Autauga County 1 Unit 356362.

Fha Loan Limits And Guidelines

Fha Loan Limits And Guidelines

FHA loans are a low down payment mortgage program and Alabama FHA loan limits are connected to local home values.

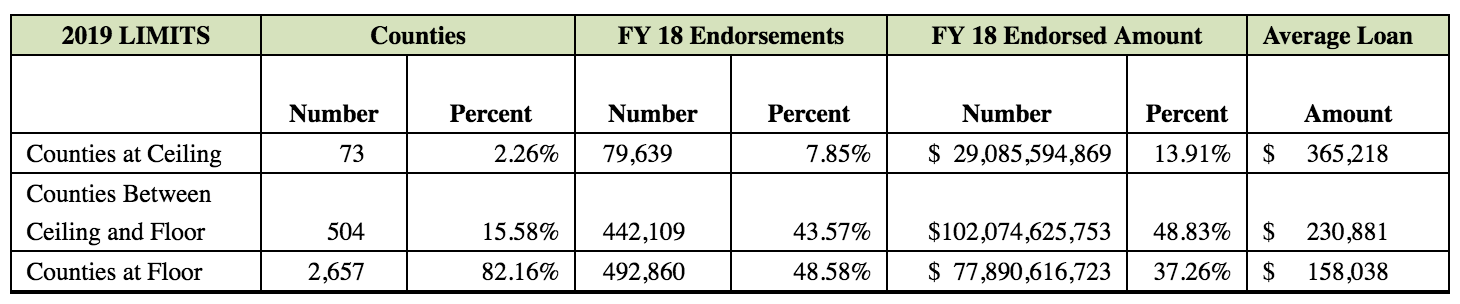

Maximum fha loan amount alabama. Areas Between Floor and Ceiling. It applies to high cost areas in the United States and is illustrated in the table below. Those are the median price estimates used for loan limit determination.

View the current FHA and conforming loan limits for all counties in Alabama. Manufactured home only - 69678. You will need to provide at 2 years tax returns and most lenders want to see your 2 most recent.

The results page will also include a Median Sale Price value for each jurisdiction. FHA loan limits are the maximum amount that you may borrow using an FHA loan in a particular location. For 2021 the maximum loan limit in Alabama is 356362 for a single-family home and 685400 for a four-plex.

VA Lending Limits for Alabama Cities Although VA guaranteed loans do not have a maximum dollar amount lenders who sell their VA loans in the secondary market must limit the size of those loans to the maximums prescribed by GNMA Ginnie Mae which are listed below. FHA loan limits in Alabama are set at the floor amount of 275665 across almost the entire state. Manufactured home lot - 23226.

FHA Mortgage Limits Search. Alabama FHA Loan Requirements. See below the list of all 2021 FHA Limit Alabama counties with 2021 loan limits for 1 2 3 and 4 Unit properties.

The high-cost area limits published in Lender Letter-2020-14 are the statutory limits provided by FHFA but should not be used to determine the loan amount. Lenders must find the applicable loan limit for countiesMSAs in the Loan Limit Look-Up Table or on FHFAs web page. Borrowers are generally given enough to finance 110 of any homes projected value after improvement set by appraisers.

10 25 50 100. The minimum loan limit is 5000. Alabama FHA Loan Limits Search.

Welcome to the FHA Mortgage Limits page. The type of loan you requested. Refer to Mortgagee Letter 20-42 for more details.

This page allows you to look up the FHA or GSE mortgage limits for one or more areas and list them by state county or Metropolitan Statistical Area. FHA loans are designed for borrowers who are unable to make large down payments. We will forward your application to one and only one FHA Approved Lender who can best help you based upon.

FHA mortgage lending limits in ALABAMA vary based on a variety of housing types and the cost of local housing. Search the charts below to determine the maximum mortgage amount allowed for your county. Complete an easy 2 minute application form.

The FHA ceiling represents the maximum loan amount and is illustrated in the table below. 25 years for a loan on a multi-section manufactured home and lot. Employment FHA loans require that you prove 2 years of consistent employment.

Single Duplex Tri-plex Four-plex. Each Alabama county conforming mortgage loan limit is displayed. Unlike other states in which FHA loan limits may vary from county to county Alabama buyers have the flexibility of being able to apply that same loan limit anywhere in the state they find their dream home.

For CY 2021 the HECM maximum nationwide claim amount will be 822375 for all areas and effective for all case numbers assigned on or after January 1 2021 through December 31 2021. A minimum of 5000 must be borrowed and maximum limits are set by the FHA that differ according to locations. Alabama FHA Home Loan.

To qualify for an FHA loan in Alabama your home loan must be below the local FHA loan limits in your area. 20 years for a loan on a manufactured home or on a single-section manufactured home and lot. Limits varies by county.

15 years for a manufactured home lot loan. The federal government has set the maximum amount an Alabamian homebuyer can borrow with an FHA loan at 356362 for a single-family home. Manufactured home.

If you would like to learn more about the requirements to get an FHA loan and view some of the best FHA lenders in Alabama visit this page. You may view the 2021 FHA loan limits for all counties in Alabama below. This represents the highest amount that a borrower can get through the FHA loan program.

FHA Loan Limits The FHA loan limits are the maximum loan amount available in a particular county. There are lower limits for homes with fewer living-units. Determine the type of FHA Government Loan that best fits your needs.

Also for 2021 the FHA ceiling was set at 822375 for single-family home loans. Credit Score To qualify for the 35 down payment you must have a 580 credit score or higherIf your credit score is between a 500-579 you still may qualify for an FHA loan but will be required to put 10 down. 2021 FHA Limit Alabama counties is 356362 and for 2-unit properties is 456275.

2021 Alabama FHA Loan Limits. Loan limits vary by county and home size.

Fha Loan Limits To Increase In Most Of U S In 2019 Housingwire

Fha Loan Limits To Increase In Most Of U S In 2019 Housingwire

Are There Income Requirements For An Fha Mortgage

Are There Income Requirements For An Fha Mortgage

Fha Loan Down Payment Requirements For 2020

Fha Loan Down Payment Requirements For 2020

2021 Conforming And Fha Loan Limits Mortgage Blog

2021 Conforming And Fha Loan Limits Mortgage Blog

How Late Payments Affect Fha Loan Approval Chances

How Late Payments Affect Fha Loan Approval Chances

New 2021 Fha Loan Limits Fha Mortgage Source

New 2021 Fha Loan Limits Fha Mortgage Source

Can You Qualify For An Fha Loan In Alabama Smg Mortgage

Can You Qualify For An Fha Loan In Alabama Smg Mortgage

Are My Tax Returns Required For An Fha Loan

Are My Tax Returns Required For An Fha Loan

Fha Loan Requirements For 2021 Fha Lenders

Fha Loan Requirements For 2021 Fha Lenders

Down Payment Assistance For Fha Loans

Down Payment Assistance For Fha Loans

2021 Fha Loan Limits In Alabama Fhaloans Guide

2021 Fha Loan Limits In Alabama Fhaloans Guide

Alabama Fha Lenders Alabama Fha Loan Requirements 2021

Alabama Fha Lenders Alabama Fha Loan Requirements 2021

Fha Loan Closing Cost Calculator

Fha Loan Closing Cost Calculator

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

Can I Make An Fha Home Purchase For A Fixer Upper

Can I Make An Fha Home Purchase For A Fixer Upper

Fha Loan Limits For 2020 Forbes Advisor

Fha Loan Limits For 2020 Forbes Advisor

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information