Loan Shark Protection Act

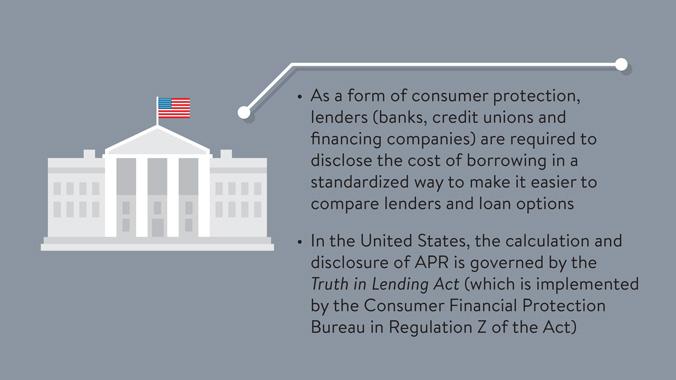

The Loan Shark Prevention Act is an amendment to the Truth in Lending Act TILA a 1968 law that requires lenders to disclose the terms of a loan to borrowers. A loan shark came to be understood as a black-market creditor with ties to organized crime who employed violence or threats of violence to compel repayment of a debt.

The Loan Shark Prevention Act Nationofchange

The Loan Shark Prevention Act Nationofchange

Jaime GreenThe Wichita Eagle via AP Last month Sen.

Loan shark protection act. It includes language that would prevent lenders from adding fees to evade the interest rate cap and sets penalties. Title II of the Consumer Credit Protection Act is within Congress power under the Commerce Clause to control activities affecting interstate commerce and Congress findings are adequate to support its conclusion that loan sharks who use extortionate means to collect payments on loans are in a class largely controlled by organized crime with a substantially adverse effect on interstate commerce. The difficulty in such instances is that loan sharks usually work under the cover of anonymity.

A National consumer credit usury rate Section 107 of the Truth in Lending Act 15 USC. Protects borrowers from loan sharks Also this Act has prevented borrowers from falling prey to the hands of loan sharks. But sharks arent new to the financial waters.

Nationwide Cap on Interest. Only businesses that abide by the terms and regulations of the Moneylenders Act are given licenses to operate. The difficulty in such instances is that loan sharks usually work under the cover of anonymity.

To protect consumers from usury. Bernie Sanders and Rep. This Act may be cited as the Loan Shark Prevention Act.

Loan Shark Protection Acts Sept 30 1995. Loan Shark Prevention Act is only two pages long. 1606 is amended by adding at the end the following new subsection.

In 1968 Congress enacted the Consumer Credit Protection Act the second. This bill would rename so called payday loans and start calling them short term loans. It would then allow check cashing outlets to grant these loans at an outrageous interest rate that would far exceed the 25 allowed today.

It includes language that would prevent lenders from adding fees to evade the interest rate cap and sets penalties for violators including a forfeiture of all interest on the illegal loans Its Alexandria Ocasio-Cortezs first bill jointly with Bernie Sanders. The Loan Shark Prevention Act anticipates that argument and counters with the promise that such unbanked working families would gain access to reasonably-priced alternative credit when they need. Recently members of the United States Senate and United States House of Representatives have introduced the Loan Shark Prevention Act which imposes a nationwide 15 interest rate ceiling on all consumer credit products from credit cards to payday loans.

The Loan Shark Protection Act would limit the interest charged on credit cards to 15 percent. A 15 percent cap would be too low naively too low. Alexandria Ocasio-Cortez debuted the Loan Shark Prevention Act whose chief provision amounts to a national interest rate ceiling of 15.

Which was depicted as extortionate. Alexandria Ocasio-Cortez debuted the Loan Shark Prevention Act whose chief provision amounts to a national interest. Congress enacts Truth in Lending Act reform easing regulations on creditors.

The law would limit interest on all types of consumer loans to 15. In GovTrackus a database of bills in the US. It would add a new section to the TILA with these provisions.

A 15 percent cap would be too low naively too low. To amend the Truth in Lending Act to protect consumers from usury and unreasonable fees and for other purposes. If you are able to ascertain the identity of loan sharks or have been harassed by debt collection agencies you may wish to consider applying for a Protection Order under the Protection from Harassment Act Chap 256A against these individuals.

Bernie Sanders and Rep. The Loan Shark Protection Act would limit the interest charged on credit cards to 15 percent. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled SECTION 1.

They also propose to empower the United States Post Office to engage in the practice of consumer retail banking. The bill is called the Loan Shark Prevention Act and its only two pages long. Bill McCollum R-Fla a key recipient of finance insurance and real estate fire donations 136000 in 1993-94.

Recently legislators have worked to enact laws that would set a national interest rate ceiling of 15 to protect consumers from loan sharks who often charge interest rates that average around 30 times higher than the proposed ceiling. PressReleasePoint Free Press Release Distribution Website. Bill powered through by Rep.

The Loan Shark Protection Act. If you are able to ascertain the identity of loan sharks or have been harassed by debt collection agencies you may wish to consider applying for a Protection Order under the Protection from Harassment Act Chap 256A against these individuals.

Know Your Lender Loan Consumer Protection Lending

Know Your Lender Loan Consumer Protection Lending

New Law Fails To Deter Harassment By Loan Sharks Ahmedabad News Times Of India

New Law Fails To Deter Harassment By Loan Sharks Ahmedabad News Times Of India

What To Know When Applying For A New Ppp Loan By March 31

What To Know When Applying For A New Ppp Loan By March 31

The Unnerving And Predatory Scheme Of Internet Loans Richmond Journal Of Law And Technology

The Unnerving And Predatory Scheme Of Internet Loans Richmond Journal Of Law And Technology

Admiralty Law Liberal Dictionary Admiralty Law Law Works Law

Admiralty Law Liberal Dictionary Admiralty Law Law Works Law

Banks Made Billions On Ppp Loans Learn What They Re Doing With The Cash

Banks Made Billions On Ppp Loans Learn What They Re Doing With The Cash

The Sanders Aoc Protection For Loan Sharks Act Realclearpolitics

The Sanders Aoc Protection For Loan Sharks Act Realclearpolitics

Internet Lenders Want To Pick The Law That Applies To Their Loans In Va Virginia Poverty Law Center Virginia Poverty Law Center

Internet Lenders Want To Pick The Law That Applies To Their Loans In Va Virginia Poverty Law Center Virginia Poverty Law Center

Millions Deceived By Citibank Credit Card Add On Practices No Credit Loans Finance Commercial Bank

Millions Deceived By Citibank Credit Card Add On Practices No Credit Loans Finance Commercial Bank

Loan Shark Prevention Act 2019 116th Congress S 1389 Govtrack Us

Hurricane Victims Can Get A Break On Mortgage Payments But Beware Of Scams With Images Mortgage Payment Mortgage Protection Insurance Mortgage Loans

Hurricane Victims Can Get A Break On Mortgage Payments But Beware Of Scams With Images Mortgage Payment Mortgage Protection Insurance Mortgage Loans

How To Avoid Being Bitten By A Loan Shark Finder Com Au

How To Avoid Being Bitten By A Loan Shark Finder Com Au

Great White Vanishing Act Where Have South Africa S Famous Sharks Gone Shark Crowd Drawing Marine Ecosystem

Great White Vanishing Act Where Have South Africa S Famous Sharks Gone Shark Crowd Drawing Marine Ecosystem

Bankmarketingcenter The Newest Threat To Americans In Need Loan Sharks

Bankmarketingcenter The Newest Threat To Americans In Need Loan Sharks

Legislators Choose E Loan Sharks Over Their Constituents And Legitimate Virginia Lenders Virginia Poverty Law Center Virginia Poverty Law Center

Legislators Choose E Loan Sharks Over Their Constituents And Legitimate Virginia Lenders Virginia Poverty Law Center Virginia Poverty Law Center

The Sanders Aoc Protection For Loan Sharks Act Cato Institute

The Sanders Aoc Protection For Loan Sharks Act Cato Institute

Stamp Text Social Media Stock Vector Affiliate Social Text Stamp Vector Ad In 2020 Payday Loans Payday Best Payday Loans

Stamp Text Social Media Stock Vector Affiliate Social Text Stamp Vector Ad In 2020 Payday Loans Payday Best Payday Loans

Why You Should Avoid Payday Loans And What To Do Instead Dupaco

Why You Should Avoid Payday Loans And What To Do Instead Dupaco