Fha Loan Limits Maryland

Conventional Loan Limits in Caroline County are 548250 for 1 living-unit homes to 1054500 for 4 living-units. This represents the highest amount that a borrower can get through the FHA loan program.

Fha Loan Limits For 2020 Forbes Advisor

Fha Loan Limits For 2020 Forbes Advisor

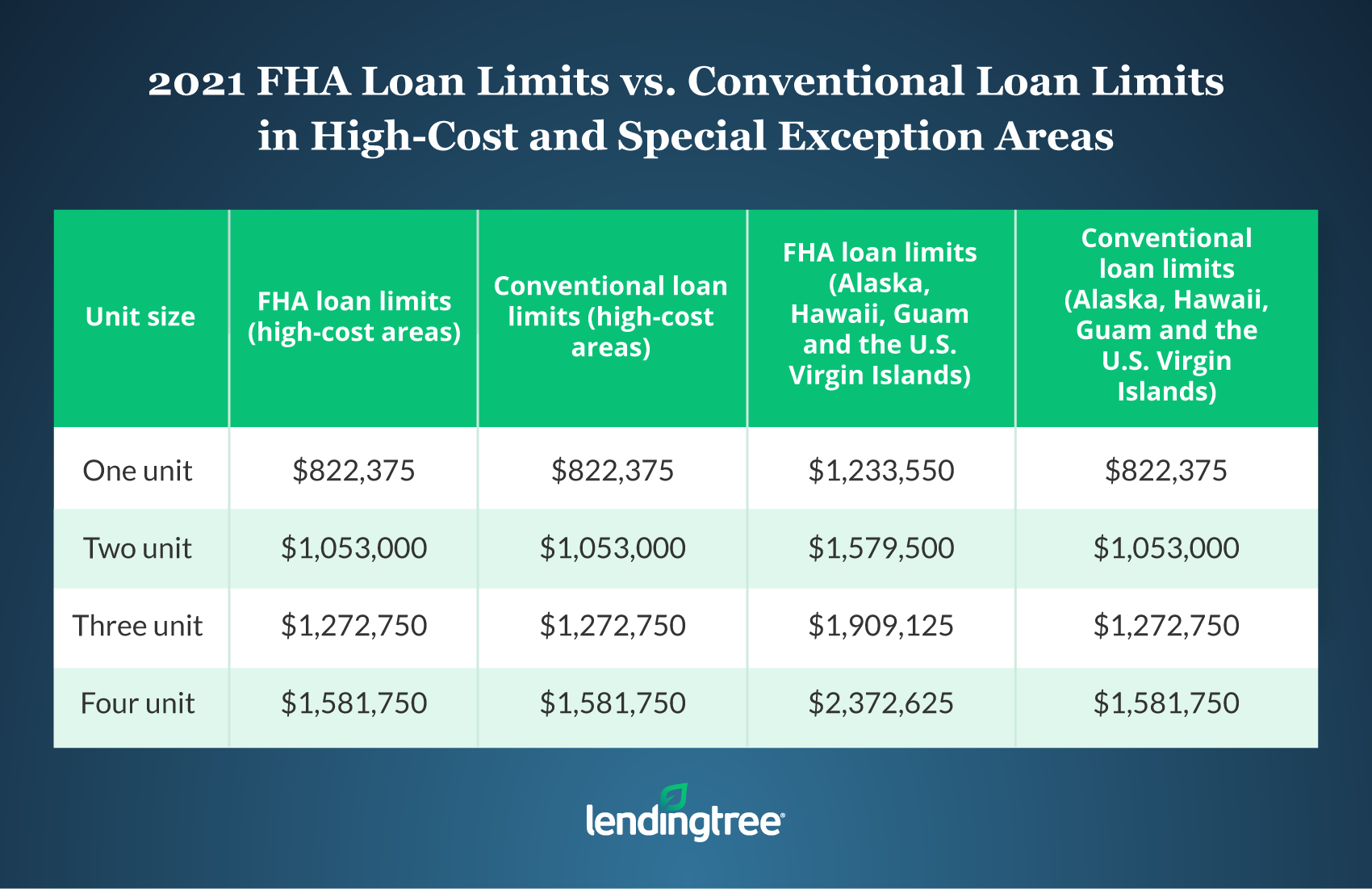

FHAs nationwide forward mortgage limit floor and ceiling for a one-unit property in CY 2021 are 356362 and 822375 respectively.

Fha loan limits maryland. One of the reasons that FHA loans are so popular is because of the low down payment option. Since FHA loans are quite easy to qualify for they are quite popular among home buyersin Maryland. So on a 200000 loan the down payment would need to be 7000.

Maryland First Time Home Buyer Loan. Loan Limit Summary Limits for FHA Loans in Caroline County Maryland range from 356362 for 1 living-unit homes to 685400 for 4 living-units. 2021 Conforming Limit Maryland for 2-unit properties is 702000 and goes up to 1053000 for high-cost counties.

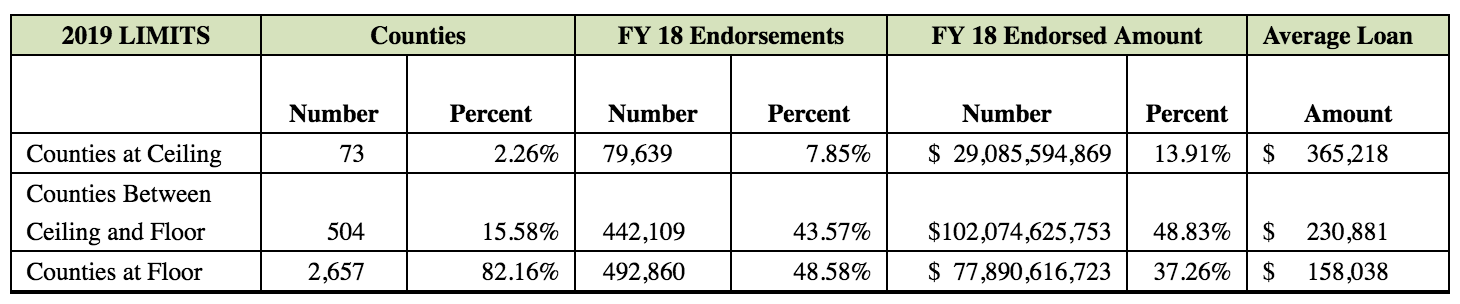

These Mortgagee Letters provide the mortgage limits for Title II FHA-insured forward mortgages and the maximum claim amount for FHA-insured HECMs for Calendar Year CY 2021. FHA loan limits are different than those for conventional mortgages as they use a formula based on median home prices. Check to see what the loan limits are for.

2021 Conforming Limit Maryland is 548250 and goes up to 822375 for high-cost counties for one-unit properties. 2021 CONFORMING LOAN LIMITS FOR MARYLAND MD Shashank Shekhar. If your credit score is below a 580 you may need to place as much as 10 down in order to qualify.

Maryland has 24 counties with FHA Limits ranging from a low of. These limits vary by area. FHA Loan Limits The FHA loan limits are the maximum loan amount available in a particular county.

Maryland FHA Mortgage Loan Limits Low Rate Home Refinance and Purchase Loans Maryland homeowners will benefit from new increased FHA mortgage loan limits with fixed rate refinance loans up to 729050 in designated high cost areas. FHA loan limits in Maryland vary widely from 356362 in more rural low-cost areas to 822375. The FHA program makes buying a home easier and less expensive than any other types of real estate mortgage home loan programs.

The FHA Federal Housing Administration was created to help the average American have a chance at owning their own home. City Single Family Home 0 down and up to. It applies to high cost areas in the United States and is illustrated in the table below.

Each Maryland county loan limit is displayed. The FHA ceiling represents the maximum loan amount and is illustrated in the table below. This page allows you to look up the FHA or GSE mortgage limits for one or more areas and list them by state county or Metropolitan Statistical Area.

In areas with higher home prices the. As such FHA loan limits are reset each year and vary from county to county in each state. FHA loans are designed for borrowers who are unable to make large down payments.

2021 VA Loan limits for all cities in Maryland. FHA loans provide a great opportunity to buy a home in Maryland. The results page will also include a Median Sale Price value for each jurisdiction.

The 2021 FHA loan limits for each county in Maryland are below. The 2021 Home Equity Conversion Mortgage HECM limits in Caroline County is 822375. Home refinancing has never been easier with cash out loans available up to 95 for qualified borrowers.

In most areas the limit for a single-family home is 314827. Loan Limits in Maryland. Normally the credit score required needs to be 580 or above.

The FHA limits the size of the mortgages it insures. 24 match es found. Those are the median price estimates used for loan limit determination.

Also for 2021 the FHA ceiling was set at 822375 for single-family home loans. Lending Limits for FHA Loans in MARYLAND Counties. This FHA loan program was created to help increase homeownership.

FHA mortgage lending limits in MARYLAND vary based on a variety of housing types and the cost of local housing. FHA loans allow you to purchase a home with only a 35 down payment. FHA loan requirements 2021.

Welcome to the FHA Mortgage Limits page. However buyers who have credit scores lower than 580 can still qualify. For FHA loans Base Loan Amount plus the FHA Up Front Mortgage Insurance Premium UFMIP may not exceed 548250 For VA RHS and Conventional loans base loan amount plus VA funding fee RHS guarantee fee or conventional single premium mortgage insurance may not exceed 548250.

You can view the 2021 FHA loan limits for Maryland on this page.

Fha Loan Limits In 2021 Lendingtree

Fha Loan Limits In 2021 Lendingtree

Fha Loan Limits Increasing For Almost All Of U S In 2020 Housingwire

Fha Loan Limits Increasing For Almost All Of U S In 2020 Housingwire

2014 Fha Loan Limits Marney Kirk Maryland Real Estate Agent

2014 Fha Loan Limits Marney Kirk Maryland Real Estate Agent

Fha Loan Limits To Increase In Most Of U S In 2019 Housingwire

Fha Loan Limits To Increase In Most Of U S In 2019 Housingwire

Maryland Fha Lenders Maryland Fha Loans 2021 Fha Lenders

Maryland Fha Lenders Maryland Fha Loans 2021 Fha Lenders

Fha Loan Maryland Lender Rates Calculator Requirements Limits 2021 Credit Score Ability Mortgage Group

Fha Loan Maryland Lender Rates Calculator Requirements Limits 2021 Credit Score Ability Mortgage Group

Maryland Fha Loan Requirements Limits 2018 Guidelines How To Apply

Maryland Fha Loan Requirements Limits 2018 Guidelines How To Apply

Fha Loan Limits Maryland 2020 Fha Renovation Loans Llc

Fha Loan Limits Maryland 2020 Fha Renovation Loans Llc

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Maryland Loan Limits For Fha Va Conforming Loans

Fha Loan Maryland Loan Limits For Fha Va Conforming Loans

New 2021 Fha Loan Limits Fha Mortgage Source

New 2021 Fha Loan Limits Fha Mortgage Source

Fha Loan Limits For 2021 Lookup By County Fha Lenders

Fha Loan Limits For 2021 Lookup By County Fha Lenders

Fha Loan Closing Cost Calculator

Fha Loan Closing Cost Calculator

Maryland Fha Loan Limits For 2015 Maryland Mortgages

Fha Loan Limits For 2016 Prmi Delaware

Fha Loan Limits For 2016 Prmi Delaware

Naca Conforming Loan Limits For Maryland 2019 Kristopher Fraley Dc Maryland Virginia

Naca Conforming Loan Limits For Maryland 2019 Kristopher Fraley Dc Maryland Virginia